Bitcoin Backlash: Trump's Truth Social Post Sparks Crypto Controversy

Market manipulation or just careless comments from Trump?

It would appear that recent fluctuations in the prices of Bitcoin and many other cryptocurrencies can be credited (or blamed) on the same entity that’s responsible for most other significant events of the last few weeks — President Donald Trump.

It was a post on his Truth Social platform regarding the much-debated U.S. strategic reserve of cryptocurrencies that has sent shockwaves through the cryptocurrency market, sparking both excitement and skepticism among investors, critics, and commentators.

The Announcement and Its Immediate Impact

Trump’s post — significantly made on Sunday March 2nd when traditional financial markets were closed — outlined details regarding his vision for a “Crypto Strategic Reserve,” which he described as a move to elevate the cryptocurrency industry and position the United States as a global leader in digital assets.

He emphasized that this reserve would include major cryptocurrencies, referencing a number of the lesser-known tokens such as Ripple, Solana, and Cardano. The announcement was framed as a response to what Trump called “years of corrupt attacks” on the crypto industry by the previous administration, conforming to the Trump playbook where no post or statement is complete without finger-pointing and recrimination.

The immediate market reaction was dramatic. Ripple and Solana experienced significant gains of 25% and 20% respectively. Cardano’s price soared by over 60%. The rally appeared to be fueled by investor optimism about the potential for increased adoption and legitimacy of cryptocurrencies under a U.S.-backed reserve system. The market capitalization of crypto as a whole went up 11% in the space of just a few hours.

More notable to those who’ve followed the rise of the self-appointed ‘Crypto President’, was that his post on Truth Social appeared to ignore Bitcoin.

The recent meteoric rise in price of BTC has been attributed in large part to Trump’s rise to power, and the prospect of him actually following through with some of his campaign promises.

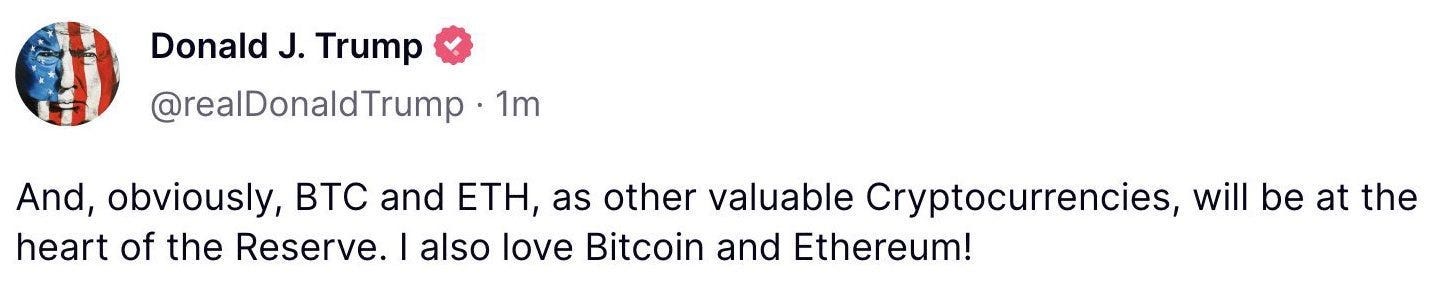

As if responding to prompts from influential Bicoiners, Trump later added a further post to his Truth Social post, appearing to suggest that the inclusion of Bitcoin and Ethereum were implied, if not explicitly stated.

Bitcoin responded accordingly with a $10k jump in price.

Market speculation and faltering investor sentiment

Trump’s initial announcement led to a wave of speculative trading, as investors rushed to capitalize on the perceived endorsement of cryptocurrencies by the U.S. government. This speculative activity contributed to heightened volatility, with prices experiencing sharp spikes followed by gradual declines as the initial excitement waned.

More significantly perhaps, was that this recent occurrence appears to have revived the fortunes of alt-coins — the entire class of crypto considered to be the ‘alternative’ to Bitcoin. The events of recent days have served to further divide the crypto establishment with some remaining bullish about the future under Trump, while others struggle to make sense of it all and share their cynicism over social media.

Renowned industry commentator and fellow of the Bitcoin Policy Institute — Troy Cross — was unrelenting in his opinion on Twitter, commenting:

“I can’t find the words to express my dismay and disgust.”

Perhaps as telling were the opinions of leading crypto exchanges who chose to share their opinions on Twitter. Brian Armstrong, CEO of Coinbase was one to voice his opinion:

Armstrong’s opinion was echoed by the chairman of Kraken — Jesse Powell who tweeted words to the same effect, largely in favor of a Bitcoin reserve but not a crypto-reserve at all costs.

Suggestions insider-trading or market manipulation?

Perhaps more alarming to observers is the notion that there could have been efforts at crypto-market manipulation by Trump, his family and his entourage.

In much the same way as Trump stood to gain financially from the inflow of investment in his $TRUMP meme coin as new investors rushed to buy-in while pushing the price upwards, speculation has been rife on social media that his Truth Social post may have been intended to inflate the price of Ripple, Cardano and Solana in the short term allowing existing holders to sell and profit; pump and dump scam, in other words.

Whether Trump and his insiders benefited financially from the after-effects of his Truth Social post, or whether it was even a case of deliberate market manipulation is not clear. Could it be a case of hiding in plain sight, making moves that appear so obviously to be corrupt so as to never credibly be suspected of being so?

Is this what Trump intended with crypto?

Regardless of Trump’s intent, and regardless of whether he intended to gain financially from the effects of his post or not, the announcement comes at a time when the global economy is grappling with inflation, rising interest rates, and geopolitical tensions.

These factors have already created a challenging environment for risk assets like cryptocurrencies. Trump’s proposal to create a strategic crypto reserve of some sort has added another layer of complexity as investors weigh the potential benefits of a U.S.-backed reserve against the broader economic backdrop.

What will happen next is anybody’s guess — what seems clear though, is that the first few weeks under the so-called Crypto President have been hard to predict, and the chaos looks set to continue.

Note: This article is for informational purposes only. It should not be considered Financial or Legal Advice. Consult a financial professional before making any major financial decisions.